Some Known Questions About Paul Burrowes - Realtor David Lyng Real Estate.

Table of ContentsPaul Burrowes - Realtor David Lyng Real Estate for BeginnersFacts About Paul Burrowes - Realtor David Lyng Real Estate RevealedThe Best Strategy To Use For Paul Burrowes - Realtor David Lyng Real EstateThe Paul Burrowes - Realtor David Lyng Real Estate StatementsGetting The Paul Burrowes - Realtor David Lyng Real Estate To Work

JLLIPT will pay significant charges to our advisor, which boosts your risk of loss. JLLIPT has a background of operating losses and can not guarantee you that JLLIPT will certainly attain earnings. Our expert will deal with conflicts of rate of interest as a result of, among various other things, time restraints, appropriation of investment possibilities, and the fact that the charges it will certainly obtain for solutions provided to us will certainly be based upon our NAV, which it is accountable for computing.Except as otherwise needed by federal safeties legislations, we do not take on to openly update or change any positive declarations, whether as an outcome of new details, future events or otherwise. This sales material should be read in combination with the prospectus in order to fully recognize all the effects and dangers of the offering of protections to which it associates.

Investors could lose all or a substantial amount of their investment. Alternative financial investments are suitable just for eligible, lasting financiers that are ready to discard liquidity and put resources at risk for an indefinite duration of time.

The Ultimate Guide To Paul Burrowes - Realtor David Lyng Real Estate

JLLIPT believes the expectations mirrored in such progressive declarations are based upon affordable assumptions, we can give no assurance that the assumptions will certainly be attained or that any deviation will not be product. Home listings in Scotts Valley, CA. JLLIPT takes on no obligation to update any kind of positive statement had herein to conform the statement to real outcomes or changes in our assumptions

Intrigued in diversifying your investment portfolio beyond pension? Whether you're a novice or a skilled capitalist, navigating the myriad of investment choices offered can be frustrating. From supplies to copyright, the selections are huge. Yet allow's focus on one choice: property. Discover exactly how genuine estate financial investments can enhance your financial well-being, with a special emphasis on tax obligation advantages.

Facts About Paul Burrowes - Realtor David Lyng Real Estate Uncovered

Thankfully, the real estate tax reduction permits you to compose that amount off when you submit federal earnings tax obligations the following year - Scotts Valley, California, homes for sale. It's worth bearing in mind that this tax obligation deduction is subject to certain state and neighborhood restrictions and limitations. Make sure to make clear any lingering questions with your tax obligation professional

If you proactively join realty investing, you might be able to subtract as much as $25,000 in easy losses1 against your passive earnings. This is restricted to investment properties in which you are presently active. If you sell a residential property due to the fact that it's bringing in losses, you can no much longer utilize this reduction.

Whenever you sell a financial investment home, the IRS desires you to pay capital gains taxes on the quantity of make money from the sale. Usually, capital gains taxes are a strained portion that's subtracted from the profit on sales of funding, like property. If you purchased a residential property for $500,000 in 2015 and sold it for $750,000 in 2023, you have actually made a $250,00 revenue.

Not known Incorrect Statements About Paul Burrowes - Realtor David Lyng Real Estate

Nevertheless, I can not emphasize strongly enough that, prior to choosing, you need to talk about how property financial investments suit your profile with your economic consultant and clear up all needs, implications, and tax obligation advantages with your certified public accountant or tax advisor. One of the obstacles to access for several potential financiers when evaluating the waters of real estate is that regardless of the passive wide range build-up, financial investment residential or commercial properties include additional obligations, such as physical and management jobs.

However, there are methods to take pleasure in the benefits of actual estate investing without needing you to be actively engaged - Scotts Valley neighborhoods. Below at Canyon View Capital, we comprehend the ins and outs of property investing. That's because, for over 40 years, our professionals take care of a realty portfolio that has grown to over $1B3 in aggregated worth

Valued at even more than $230 trillion, property financial investments are the globe's biggest possession course and among one of the most entrepreneurial fields, attracting people in with the pledge of foreseeable, long-term easy income, positive returns on investments, and favorable tax benefits. Since property is frequently taken into consideration a low-risk investment, numerous are quick to enter with expectations of transforming a quick earnings.

An Unbiased View of Paul Burrowes - Realtor David Lyng Real Estate

Not all actual estate financial investments are low threat. Some call for specific genuine estate skills and many require perseverance and time to understand a positive return on investment.

Before you become a financier, it is very important to recognize the various kinds of actual estate and regular zoning policies to assist you on what to consist of in your financial investment portfolio. Residential actual estate is property that has actually been particularly zoned for living in. This consists of single- and multi-family homes and apartment.

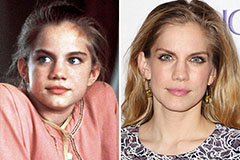

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now!